SCHEDULE 14A(RULE 14A-101)INFORMATION REQUIRED IN PROXY STATEMENT

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATIONPROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE SECURITIESEXCHANGE ACT OF

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (AMENDMENT NO.

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ |

| Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||||

x | Definitive Proxy Statement | |||||

¨ | Definitive Additional Materials | |||||

¨ | Soliciting |

AMERICREDIT CORP.

(Name of Registrant as Specified inIn Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing feeFiling Fee (Check the appropriate box):

x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the |

| (1) | Amount |

| (2) | Form, |

| (3) | Filing |

| (4) | Date |

Notes:

![]()

801 Cherry Street, Suite 3900

Fort Worth, Texas 76102

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Dear AmeriCredit Shareholder:

On Tuesday,Wednesday, November 6, 2001,5, 2003, AmeriCredit Corp. will hold its 20012003 Annual Meeting of Shareholders at the Fort Worth Club, 306 West Seventh Street, Fort Worth, Texas. The meeting will begin at 10:00 a.m.

Only shareholders who owned stock at the close of business on Thursday,Friday, September 20, 200112, 2003 can vote at this meeting or any adjournments that may take place. At the meeting we will:

| 1. | Elect |

| 2. | Consider and vote upon |

| 3. |

| 4. | Attend to other business properly presented at the meeting. |

Your Board of Directors recommends that you vote in favor of the proposals outlined in the Proxy Statement.

At the meeting, we will also report on AmeriCredit'sAmeriCredit’s fiscal 20012003 business results and other matters of interest to shareholders.

The approximate date of mailing for the Proxy Statement, proxy card and AmeriCredit's 2001AmeriCredit’s 2003 Annual Report is September 26, 2001.30, 2003.

We hope you can attend the Annual Meeting. Whether or not you can attend, pleaseread the enclosed Proxy Statement. When you have done so, pleasemark your votes on the enclosed proxy card,sign and date the proxy card, andreturn it to us in the enclosed envelope. Your vote is important, so please return your proxy card promptly.

Sincerely,

CHRIS A. CHOATE

Secretary

September 29, 2003

PROXY STATEMENT

FOR

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD NOVEMBER 6, 20015, 2003

SOLICITATION AND REVOCABILITY OF PROXIES

The accompanying proxy is solicited by the Board of Directors on behalf of AmeriCredit Corp., a Texas corporation ("AmeriCredit"(“AmeriCredit” or the "Company"“Company”), to be voted at the 20012003 Annual Meeting of Shareholders of AmeriCredit (the "Annual Meeting"“Annual Meeting”) to be held on November 6, 2001,5, 2003 at the time and place and for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders (the "Notice"“Notice”) and at any adjournment(s) thereof.When proxies in the accompanying form are properly executed and received, the shares represented thereby will be voted at the Annual Meeting in accordance with the directions noted thereon; if no direction is indicated such shares will be voted for the election of directors and in favor of the other proposals set forth in the Notice.

The principal executive offices of AmeriCredit are located at 801 Cherry Street, Suite 3900, Fort Worth, Texas 76102. AmeriCredit'sAmeriCredit’s mailing address is the same as its principal executive offices.

This Proxy Statement and accompanying proxy are being mailed on or about September 26, 2001. AmeriCredit's30, 2003. AmeriCredit’s Annual Report on Form 10-K covering the Company'sCompany’s fiscal year ended June 30, 20012003 is enclosed herewith, but does not form any part of the materials for solicitation of proxies.

The enclosed proxy, even though executed and returned, may be revoked at any time prior to the voting of the proxy by giving written notice of revocation to the Secretary of the Company at the Company'sCompany’s principal executive offices or by executing and delivering a later-dated proxy or by attending the Annual Meeting and voting in person. However, no such revocation shall be effective until such notice has been received by the Company at or before the Annual Meeting. Such revocation will not affect a vote on any matters taken prior to receipt of such revocation. Mere attendance at the Annual Meeting will not of itself revoke the proxy.

In addition to the solicitation of proxies by use of the mail, the directors, officers and regular employees of the Company may solicit the return of proxies either by mail, telephone, telegraph, or through personal contact. Such officers and employees will not be additionally compensated but will be reimbursed for out-of-pocket expenses. AmeriCredit has also retained Georgeson Shareholder Communications, Inc. ("GSC"(“GSC”) to assist in the solicitation of proxies from shareholders and will pay GSC a fee of approximately $8,000$10,000 for its services and will reimburse such firm for its out-of-pocket expenses. Brokerage houses and other custodians, nominees, and fiduciaries will be requested to forward solicitation materials to the beneficial owners. The cost of preparing, printing, assembling and mailing the Annual Report, the Notice, this Proxy Statement and the enclosed proxy, as well as the cost of forwarding solicitation materials to the beneficial owners of shares and other costs of solicitation, will be borne by AmeriCredit.

Some banks, brokers and other record holders have begun the practice of “householding” proxy statements and annual reports. “Householding” is the term used to describe the practice of delivering a single set of the proxy statement and annual report to any household at which two or more shareholders reside if a company reasonably believes the shareholders are members of the same family. This procedure would reduce the volume of duplicate information shareholders receive and would also reduce the Company’s printing and mailing costs. The Company will promptly deliver an additional copy of either document to any shareholder who writes or calls the Company at the following address or phone number: Investor Relations, AmeriCredit Corp., 801 Cherry Street, Suite 3900, Fort Worth, Texas 76102, (817) 302-7000.

PURPOSES OF THE MEETING

At the Annual Meeting, the shareholders of AmeriCredit will consider and vote on the following matters:

1. The election of four directors to terms of office expiring at the Annual Meeting of Shareholders in 2006, or until their successors are elected and qualified, and the election of two directors to a term of office expiring at the Annual Meeting of Shareholders in 2005, or until their successors are elected and qualified;

2. The approval of the proposal to amend the Company’s Employee Stock Purchase Plan (the “Purchase Plan”) to increase the number of shares of the Company’s Common Stock reserved under the Purchase Plan from 3,000,000 to 5,000,000;

3. The ratification of the appointment by the Company’s Audit Committee of PricewaterhouseCoopers LLP as independent public accountants for the Company for the fiscal year ending June 30, 2004; and

4. The transaction of such other business that may properly come before the Annual Meeting or any adjournments thereof.

QUORUM AND VOTING

The record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting was the close of business on September 20, 200112, 2003 (the "Record Date"“Record Date”). On the Record Date, there were 84,339,085156,453,979 shares of Common Stock of the Company, par value $0.01 per share, outstanding, each of which is entitled to one vote on all matters to be acted upon at the Annual Meeting. There are no cumulative voting rights. The presence, in person or by proxy, of holders of a majority of the outstanding shares of Common Stock entitled to vote at the meeting is necessary to constitute a quorum to transact business. Assuming the presence of a quorum, the affirmative vote of the holders of a plurality of the shares of Common Stock represented at the Annual Meeting is required for the election of directors, and the affirmative vote of the holders of a majority of the shares of Common Stock represented at the Annual Meeting is required for the approval of the amendment to the Purchase Plan and for the ratification of the appointment by the Board of Directors of PricewaterhouseCoopers LLP as independent public accountants for the Company for the fiscal year ending June 30, 2002. Approval of the amendment to the Company's Articles of Incorporation to increase the authorized number of shares of Common Stock from 120,000,000 to 230,000,000 requires the affirmative vote of at least two-thirds of the outstanding shares entitled to vote.2004.

Abstentions and broker non-votes are counted towards determining whether a quorum is present. Broker non-votes will not be counted in determining the number of shares voted for or against the proposed matters, and therefore will not affect the outcome of the vote except that a broker non-vote will have the same effect as a "no" vote on the proposed amendment to the Articles of Incorporation since adoption of such amendment requires at least two-thirds of the outstanding shares entitled to vote. Abstentions on a particular item (other than the election of directors) will be counted as present and voting for purposes of any item on which the abstention is noted, thus having the effect of a "no"“no” vote as to that proposal because each proposal (other than the election of directors) requires the affirmative vote of a majority of the shares voting at the meeting. With regard to the election of directors, votes may be cast in favor of or withheld from each nominee; votes that are withheld will be excluded entirely from the vote and will have no effect.

2

PRINCIPAL SHAREHOLDERS AND STOCK OWNERSHIP OF MANAGEMENT

The following table and the notes thereto set forth certain information regarding the beneficial ownership of the Company's Common StockCompany’s common stock as of the Record Date, by (i)(1) each current director and nominee for director of the Company; (ii)(2) each Named Executive Officer (as defined in the "Executive Compensation-Summary Compensation Table" on page 8Officer; (3) all of this Proxy Statement); (iii) allour present executive officers and directors of the Company as a group; and (iv)(4) each other person known to the Companyus to own beneficially more than five percent of theour presently outstanding Common Stock.common stock. Unless otherwise indicated, the address for the following shareholders is 801 Cherry Street, Suite 3900, Fort Worth, Texas 76102.

| Common Stock Owned Beneficially (1) | Percent of Class Owned Beneficially (1) | |||||

|---|---|---|---|---|---|---|

| Liberty Wanger Asset Management, L.P. | 5,916,900 | (2) | 7.02% | |||

| Clifton H. Morris, Jr | 2,349,610 | (3) | 2.74% | |||

| Michael R. Barrington | 1,061,746 | (4) | 1.24% | |||

| Daniel E. Berce | 1,657,865 | (5) | 1.93% | |||

| Edward H. Esstman | 875,426 | (6) | 1.03% | |||

| A. R. Dike | 115,000 | (7) | * | |||

| James H. Greer | 528,908 | (8) | * | |||

| Douglas K. Higgins | 266,000 | (9) | * | |||

| Kenneth H. Jones, Jr | 215,000 | (10) | * | |||

| Michael T. Miller | 130,316 | (11) | * | |||

| All Present Executive Officers and Directors as a Group | ||||||

| (16 Persons) (3)(4)(5)(6)(7)(8)(9)(10)(11) | 7,702,599 | 8.55% | ||||

*

| Common Stock Owned Beneficially (1) | Percent of Class Owned Beneficially (1) | |||||

Legg Mason, Inc. | 17,300,000 | (2) | 11.06 | % | ||

Capital Guardian Trust Company | 17,200,000 | (3) | 10.99 | % | ||

Liberty Wanger Asset Management, L.P | 9,306,400 | (4) | 5.95 | % | ||

Wasatch Advisors Inc | 8,802,262 | (5) | 5.62 | % | ||

PIMCO Equity Advisors. | 8,376,000 | (6) | 5.35 | % | ||

Clifton H. Morris, Jr. | 2,912,347 | (7) | 1.84 | % | ||

Daniel E. Berce. | 2,021,516 | (8) | 1.28 | % | ||

Edward H. Esstman | 1,122,129 | (9) | * | |||

Michael R. Barrington | 1,292,386 | (10) | * | |||

John R. Clay | 0 | * | ||||

A.R. Dike | 165,300 | (11) | * | |||

Gerald J. Ford | 2,752,910 | (12) | 1.76 | % | ||

James H. Greer | 498,300 | (13) | * | |||

Douglas K. Higgins | 340,000 | (14) | * | |||

Kenneth H. Jones, Jr. | 250,000 | (15) | * | |||

B. J. McCombs | 1,000 | * | ||||

S. Mark Floyd | 113,097 | (16) | * | |||

Preston A. Miller | 261,158 | (17) | * | |||

Cheryl L. Miller | 111,011 | (18) | * | |||

All Present Executive Officers and Directors as a Group | 12,205,892 | 7.47 | % |

| * | Less than 1% |

| (1) | Except as otherwise indicated, the persons named in the table have sole voting and investment power with respect to the shares of |

| (2) | Legg Mason, Inc. reports holding an aggregate of 17,300,000 shares. The address of Legg Mason, Inc. is 100 Light Street, Baltimore, Maryland 21202. |

| (3) | Capital Guardian Trust Company reports holding an aggregate of 17,200,000 shares. The address of Capital Guardian Trust Company is 111000 Santa Monica Boulevard, Los Angeles, California 90025. |

| (4) | Liberty Wanger Asset Management, L.P. reports holding an aggregate of |

3

| Wasatch Advisors Inc. reports holding an aggregate of 8,802,262 shares. The address of Wasatch Advisors Inc. is 150 Social Hall Avenue, Salt Lake City, Utah 84111. |

| (6) | PIMCO Equity Advisors reports holding an aggregate of 8,376,000 shares. The address of PIMCO Equity Advisors is 1345 Avenue of the Americas, 50th Floor, New York, New York 10105. |

| (7) | This amount includes |

| This amount includes |

| This amount includes |

| This amount includes |

| The amount includes |

| Hunter’s Glen/Ford, Ltd., a Texas limited partnership, is the record holder of 2,752,910 shares. The general partners of Hunter’s Glen/Ford, Ltd. are Mr. Ford and Ford Diamond Corporation, a Texas corporation which is wholly-owned by Mr. Ford. The sole limited partner of Hunter’s Glen/Ford, Ltd. is a trust established for the benefit of Mr. Ford’s children. |

| (13) | This amount includes |

| This amount includes |

| This amount includes |

| This amount includes |

| (17) | This amount includes 174,040 shares subject to stock options that are currently exercisable or exercisable within 60 days. |

| (18) | This amount includes 77,740 shares subject to stock options that are currently exercisable or exercisable within 60 days. On July 14, 2003, the position of President, Consumer Services was eliminated, and Ms. Miller was reassigned to the non-executive position of Senior Vice President, Office of Portfolio Management. |

4

ELECTION OF DIRECTORS

(Item 1)

On September 7, 1999, the Board of Directors adopted amendments to the Company'sCompany’s bylaws classifying the Board of Directors into three (3) classes, as nearly equal in number as possible, each of whom would serve for three years, with one class being elected each year. The Board of Directors believes that the staggered three-year term of the classified Board of Directors helps assure the continuity and stability of management of the Company. This continuity and stability will result from the fact that with the classified Board of Directors, the majority of the directors at any given time will have prior experience as directors of the Company. The classified Board of Directors is also intended to protect shareholders'shareholders’ rights in the event of an acquisition of control by an outsider which does not have the support of the Board of Directors.

The

On September 17, 2002, AmeriCredit announced plans to add three independent directors to its Board of Directors. On June 2, 2003, the Board of Directors, has setfollowing recommendations made by the Nominating and Corporate Governance Committee, (i) adopted amendments to the Company’s Bylaws with respect to vacancies and additional directors; (ii) approved an increase in the number of directors forto ten (10); and (iii) approved the ensuing yearappointment of two (2) independent directors to fill the vacancies resulting from the increase in the number of directors. On September 26, 2003, the Board of Directors, following recommendations made by the Nominating and Corporate Governance Committee, (i) approved an increase in the number of directors to eleven (11); and (ii) approved B. J. McCombs as a nominee to the Board of Directors to be approved by the shareholders at eight (8). the 2003 Annual Meeting.

At the 20012003 Annual Meeting, three (3)four (4) Class III directors shall be elected to serve terms expiring at the 20042006 Annual Meeting, and two (2) Class III directors shall be elected to serve terms expiring at the 2005 Annual Meeting. All three (3)Other than Mr. McCombs, all nominees are currently members of the Board of Directors.

Vacancies occurring on the Board may be filled by the Board of Directors for the unexpired term of the replacement director's predecessor in office.

In order to be elected, each nominee for director must receive at least the number of votes equal to the plurality of the shares represented at the meeting, either in person or by proxy. Unless otherwise directed in the enclosed proxy, it is the intention of the persons named in such proxy to vote the shares represented by such proxy for the election of the following named nominees to the Board of Directors.

Vacancies occurring on the Board may be filled by the Board of Directors upon recommendations of the Nominating and Corporate Governance Committee for the unexpired term of the replacement director’s predecessor in office.

The Board of Directors has selected the following nominees recommended by the Nominating and Corporate Governance Committee for election to the Board of Directors:

Class I - Term to Expire at 2006 Annual Meeting

Daniel E. Berce

Edward H. Esstman

James H. Greer

Gerald J. Ford

Class III—Term to Expire at 2005 Annual Meeting

John R. Clay

B. J. McCombs

NOMINEES FOR TERMS EXPIRING IN 2006:

DANIEL E. BERCE, 49, has been a director since 1990. Mr. Berce has been President since April 2003. Mr. Berce was Vice Chairman and Chief Financial Officer from November 1996 until April 2003. Mr. Berce served as Executive Vice President, Chief Financial Officer and Treasurer from November 1994 until November 1996. Mr. Berce is also a director of Curative Health Services, Inc., a publicly held company that provides specialty health care services, and AZZ incorporated, a publicly held company that manufactures specialty electrical equipment and provides galvanizing services to the steel fabrication industry.

5

EDWARD H. ESSTMAN, 62, has been a director since 1996. Mr. Esstman has been Executive Vice President since April 2003. Mr. Esstman served Vice Chairman from August 2001 to April 2003, Executive Vice President, Dealer Services and Co-Chief Operating Officer from October 2000 to August 2001, Executive Vice President, Dealer Services from October 1999 to October 2000, Executive Vice President, Auto Finance Division from November 1996 to October 1999 and Senior Vice President and Chief Credit Officer from November 1994 to November 1996.

JAMES H. GREER, 76, has been a director since 1990. Mr. Greer is Chairman of the Board of Greer Capital Corporation as well as President of two companies involved in real estate and commercial real estate development and management. From 1985 to 2001, Mr. Greer served as Chairman of the Board of Shelton W. Greer Co., Inc., which engineers, manufactures, fabricates and installs building specialty products. Mr. Greer previously served as a director for several banks and financial institutions. Mr. Greer is also a director of Service Corporation International, a publicly held company that owns and operates funeral homes and related businesses.

GERALD J. FORD, 59, has been a director since June 2003. Mr. Ford also currently serves as Chairman of the Board and director of Liberte Investors Inc., an investment firm, a position he has held since its formation in August 1996. Mr. Ford served as the Chairman of the Board, Chief Executive Officer and director of Golden State Bancorp Inc., a holding company of California Federal Bank, from September 1998 through November 2002 when Golden State Bankcorp Inc. was acquired by Citigroup. Mr. Ford also served as Chairman of the Board, Chief Executive Officer and director of California Federal Bank from October 1994 though November 2002 and of California Federal Preferred Capital Corporation from November 1996 through November 2002, and as Chairman of the Board and director of First Nationwide Mortgage Corporation from October 1994 through November 2002. Mr. Ford is also a director of Freeport-McMoRan Cooper & Gold Inc., a publicly held company that mines and produces copper and gold, and McMoRan Exploration Co., a publicly held energy company that explores for, develops and produces natural gas and crude oil.

NOMINEES FOR TERMS EXPIRING IN 2005:

JOHN R. CLAY, 55, has been a director since June 2003. Mr. Clay was Chief Executive Officer of Practitioners Publisher Company, Inc., a leading publisher of accounting and auditing manuals for CPA firms, from 1979 to 1999. Mr. Clay has also served 12 years as a public accountant, in accounting first with Ernst & Ernst and later as a partner with Rylander, Clay & Opitz. Mr. Clay is a certified public accountant and has authored several accounting articles and financial publications.

B. J. McCOMBS, 75, is a private investor with interests in automobile dealerships, professional sports and other investments. Mr. McCombs serves as a director of Clear Channel Communication, Inc., a publicly held diversified media company that primarily operates in radio broadcasting, outdoor advertising and live entertainment, since its inception.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE INDIVIDUALS NOMINATED FOR ELECTION AS A DIRECTOR.

6

CONTINUING DIRECTORS—CLASS II—Terms Expiring in 2004:

MICHAEL R. BARRINGTON, 42,44, has been a director since 1990. Mr. Barrington has beenwas Vice Chairman, President and Chief Executive Officer and President sincefrom July 2000.2000 until April 2003. Mr. Barrington served as Vice Chairman, President and Chief Operating Officer from November 1996 untilto July 2000 and was Executive Vice President and Chief Operating Officer from November 1994May 1991 until November 1996.

DOUGLAS K. HIGGINS, 51,53, has been a director since 1996. Mr. Higgins is a private investor and owner of Higgins & Associates and has been in such position since July 1994. Mr. Higgins served as the President and Chief Executive Officer of H&M Food Systems Company, Inc. from 1983 through 1994. Mr. Higgins is also a director of Worth Bancorporation, a multi-branch bank operating in Tarrant County, Texas.

KENNETH H. JONES, JR., 66,68, has been a director since 1988. Mr. Jones, a private investor, retired as Vice Chairman of KBK Capital Corporation ("KBK"(“KBK”), a publicly held non-bank commercial finance company, in December 1999. Mr. Jones had been Vice Chairman of KBK since January 1995. Prior to January 1995, Mr. Jones was a shareholder in the Decker, Jones, McMackin, McClane, Hall & Bates, P.C. law firm in Fort Worth, Texas, and was with such firm and its predecessor or otherwise involved in the private practice of law in Fort Worth, Texas for more than five years.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE "FOR" THE ELECTION OF EACH OF THE INDIVIDUALS NOMINATED FOR ELECTION AS A DIRECTOR.

CONTINUING DIRECTORS:DIRECTORS—CLASS III—Terms Expiring in 2005:

CLIFTON H. MORRIS, JR., 66,68, has been a director since 1988. Mr. Morris has been Executive Chairman of the Board since July 2000 and has also served as Chief Executive Officer since April 2003. Mr. Morris served as Chairman of the Board and Chief Executive Officer from May 1988 to July 2000. Mr. Morris also served as President from May 1988 until April 1991 and from April 1992 to November 1996. Mr. Morris is also a director of Service Corporation International a publicly held company that owns and operates funeral homes and related businesses, and Cash America International, Inc., a publicly held pawn brokerage company.

DANIEL E. BERCE, 47, has been a director since 1990. Mr. Berce has been Vice Chairman and Chief Financial Officer of the Company since November 1996 and was Executive Vice President, Chief Financial Officer and Treasurer for the Company from November 1994 until November 1996. Mr. Berce is also a director of INSpire Insurance Solutions, Inc., a publicly held company which provides policy and claims administration services to the property and casualty insurance industry, Curative Health Services, Inc., a publicly held company that provides specialty health care services and AZZ incorporated (formerly Aztec Manufacturing, Co.), a publicly held company that manufactures specialty electrical equipment and provides galvanizing services to the steel fabrication industry.

EDWARD H. ESSTMAN, 60, has been a director since 1996. Mr. Esstman has been Vice Chairman of the Company since August 2001. Mr. Esstman served as Executive Vice President, Dealer Services and co-Chief Operating Officer from October 2000 to August 2001, Executive Vice President, Dealer Services from October 1999 to October 2000, Executive Vice President, Auto Finance Division from November 1996 to October 1999 and Senior Vice President and Chief Credit Officer from November 1994 to November 1996.

A. R. DIKE, 65,67, has been a director since 1998. Mr. Dike is the President and Chief Executive Officer of The Dike Company, Inc., a private insurance agency, and has been in such position since July 1999. Prior to July 1999, Mr. Dike was President of Willis Corroon Life, Inc. of Texas, and was in such position for more than five years. Mr. Dike previously served as a director for several insurance companies. Mr. Dike served as a director of JPMorgan Chase Bank of Tarrant County and its predecessor banks from 1977 though 1991 and currently serves as an advisory director. Mr. Dike is also a director of Cash America International.International, Inc.

7

JAMES H. GREER, 74, has been a director since 1990. Mr. Greer is Chairman of the Board of Shelton W. Greer Co., Inc. which engineers, manufactures, fabricates and installs building specialty products, and has been such for more than five years. Mr. Greer is also a director of Service Corporation International.

Standing committees of the Board include the Audit Committee, the Stock Option/Compensation Committee and the Nominating and Corporate Governance Committee.

The Audit Committee'sCommittee’s principal responsibilities consist of (i) recommending the selection of independent auditors, (ii) reviewing the scope of the audit conducted by such auditors, as well as the audit itself, and (iii) reviewing the Company'sCompany’s internal audit activities and matters concerning financial reporting, accounting and audit procedures, and policies generally.generally, and (iv) monitoring the independence and performance of the Company’s independent auditors and internal auditors. Members consist of Messrs. Dike, Greer, Higgins and Jones. In fiscal 2003, the Audit Committee met four times and, pursuant to the authority delegated to him by the Audit Committee, Mr. Jones, Chairman of the Committee, met with the Company’s independent auditors prior to the public issuance of the Company’s quarterly and annual financial results. The "Report“Report of the Audit Committee"Committee” is contained in this Proxy Statement beginning on page 19.23.

The Stock Option/Compensation Committee (i) administers the Company'sCompany’s employee stock option and other stock-based compensation plans and oversees the granting of stock options, and (ii) reviews and approves compensation for executive officers.officers and (iii) reviews Board member compensation. Members consist of Messrs. Dike, Greer, Higgins and Jones. In fiscal 2003, the Stock Option/Compensation Committee met or adopted resolutions by unanimous consent four times. The “Report of the Stock Option/Compensation Committee on Executive Compensation” is contained in this Proxy Statement beginning on page 14.

The Nominating and Corporate Governance Committee was established in August 2001. The Nominating and Corporate Governance Committee (i) establishes procedures for the nomination of directors, (ii) recommends to the Board of Directors a slate of nominees for directors to be presented on behalf of the Board for election by shareholders at each Annual Meeting of the Company, (iii) recommends to the Board appropriate nominees to fill Board vacancies, and (iv) considers nominees to the Board recommended by shareholders.shareholders, (v) recommends to the Board director nominees for each committee, (vi) establishes and oversees any corporate governance guidelines applicable to the Company, (vii) leads the annual Board evaluation of the Chief Executive Officer’s performance, (viii) oversees the Chief Executive Officer and executive succession plans and (ix) leads the Board in its annual review of the Board’s performance. Shareholders may nominate director nominees for consideration by writing to the Secretary of the Company at 801 Cherry Street, Suite 3900, Fort Worth, Texas 76102 and providing the nominee'snominee’s name, biographical data and qualifications. In order to be considered by the Nominating and Corporate Governance Committee with respect to nominees for the 2004 Annual Meeting of Shareholders, prospective nominee recommendations must be received by the Secretary no later than May 30th ofSeptember 7, 2004 and no earlier than August 8, 2004. In fiscal 2003, the year in which the Annual Meeting is to be held.Nominating and Corporate Governance Committee met one time. Members consist of Messrs. Dike, Greer, Higgins and Jones.

The Board of Directors held five regularly scheduled meetings and two special meetings during the fiscal year ended June 30, 2001.2003. Various matters were also approved during the last fiscal year by unanimous written consent of the Board of Directors. No director attended fewer than 75% of the aggregate of (i) the total number of meetings of the Board of Directors and (ii) the total number of meetings held by all committees of the Board on which such director served.

Director Compensation

Members

For fiscal year ended June 30, 2003, members of the Board of Directors currently receivereceived a $2,500 quarterly retainer fee and an additional $4,000 fee for attendance at each meeting of the Board. Members of Committees of the Board of Directors arewere paid $2,000 per quarter for participation in all committee meetings held during that quarter.

On July 1, 2003, the Stock Option/Compensation Committee revised the compensation paid to the Company’s directors. For fiscal 2004, members of the Board of Directors will receive a $24,000 annual retainer

8

fee as well as a $4,000 fee for attendance at each meeting of the Board, and members of Committees of the Board of Directors will be paid $1,500 per committee meeting. The Audit Committee Chairman will receive a $4,000 annual retainer fee, and the Stock Option/Compensation Committee Chairman and Nominating and Corporate Governance Committee Chairman will receive a $3,000 annual retainer fee. No Board of Directors fees will be paid to Messrs. Morris, Berce and Esstman, the Company’s employee directors.

At the 2000 Annual Meeting of Shareholders, the Company adopted the 2000 Limited Omnibus and Incentive Plan for AmeriCredit Corp. (the "2000 Plan"“2000 Plan”), which provides for grants to the Company'sCompany’s executive officers (other than Messrs. Morris, Barrington, Berce and Esstman) and to non-employee directors of stock options and reserves, in the aggregate, a total of 2,000,000 shares of Common Stock for issuance upon exercise of stock options granted under such plan. On November 7, 2000, the date of the Company's 2000 Annual Meeting of Shareholders,October 30, 2002, options to purchase 20,000 shares of Common Stock were granted under the 2000 Plan to each of Messrs. Dike, Greer, Higgins and Jones at an exercise price of $28.44$7.24 per share. The exercise price for the options granted to Messrs. Dike, Greer, Higgins and Jones is equal to the last reported sale price of the Common Stock on the New York Stock Exchange ("NYSE"(“NYSE”) on the day preceding the date of grant. These options, which have a term of ten years, are fully vested upon the date of grant, but may not be exercised prior to the expiration of six months after the date of grant.

The Board of Directors anticipates that an annual grant of stock options will be authorized under the 2000 Plan to non-employee directors (other than Mr. Barrington) following the 20012003 Annual Meeting of Shareholders in amounts and upon such terms as were authorized followingon October 30, 2002. Pursuant to the 2000 Annual Meetingterms of Shareholders.his separation agreement, Mr. Barrington may be considered in the discretion of the Stock Option/Compensation Committee for future grants in such amounts and on such terms as may be granted to other non-employee directors, subject to legal and plan restrictions on the ability of the Company to authorize such grants.

All directors may use the Company airplane, but are responsible for all income taxes associated with this benefit. If a director uses the Company airplane more than a predetermined number of hours a year, the director is required to pay in advance all the Company’s out-of-pocket expenses.

Compensation Committee Interlocks and Insider Participation

No member of the Stock Option/Compensation Committee is or has been an officer or employee of the Company or any of its subsidiaries or had any relationship requiring disclosure pursuant to Item 404 of Regulation S-K promulgated by the Securities and Exchange Commission ("SEC"(“SEC”). No member of the Stock Option/Compensation Committee served on the compensation committee, or as a director, of another corporation, one of whose directors or executive officers served on the Stock Option/Compensation Committee or whose executive officers served on the Company'sCompany’s Board of Directors.

9

EXECUTIVE COMPENSATION

Summary Compensation Table

The following sets forth information concerning the compensation of the Company’sCompany's Chief Executive Officer, its former Chief Executive Officer and each of the other four most highly compensated executive officers of the Company (the “Named Executive Officers”) for the fiscal years shown.

| Annual Compensation | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name and Principal Position | Fiscal Year | Salary ($) (1) | Bonus ($) | Long Term Compensation Awards Shares of Common Stock Underlying Stock Options (#) | All Other Compensation ($) (2) | ||||||||

| Clifton H. Morris, Jr | 2001 | 380,000 | 525,000 | — | 82,650 | ||||||||

| Executive Chairman | 2000 | 730,000 | 1,050,000 | — | 79,800 | ||||||||

| 1999 | 574,815 | 823,973 | — | 79,750 | |||||||||

| Michael R. Barrington | 2001 | 680,000 | 975,000 | — | 44,770 | ||||||||

| Vice Chairman, CEO & | 2000 | 630,000 | 900,000 | — | 43,819 | ||||||||

| President | 1999 | 474,815 | 673,973 | — | 44,592 | ||||||||

| Daniel E. Berce | 2001 | 655,000 | 937,500 | — | 47,989 | ||||||||

| Vice Chairman & CFO | 2000 | 630,000 | 900,000 | — | 44,566 | ||||||||

| 1999 | 474,815 | 673,973 | — | 44,370 | |||||||||

| Edward H. Esstman | 2001 | 455,000 | 531,250 | — | 48,805 | ||||||||

| Vice Chairman (3) | 2000 | 430,000 | 500,000 | — | 45,955 | ||||||||

| 1999 | 384,061 | 448,202 | — | 45,905 | |||||||||

| Michael T. Miller | 2001 | 386,849 | 453,973 | 150,000 | 8,208 | ||||||||

| Executive Vice President | 2000 | 325,000 | 325,000 | 40,000 | 5,340 | ||||||||

| & COO | 1999 | 255,000 | 255,000 | 18,400 | 5,278 | ||||||||

| Annual Compensation | Long Term Compensation Awards | |||||||||||||

Name and Principal Position | Fiscal Year | Salary ($)(1) | Bonus ($) | Other Annual Compensation ($)(2) | Restricted Stock Award(s) ($)(3) | Shares of Common Stock Underlying Stock Options (#) | All Other Compensation ($)(4) | |||||||

Clifton H. Morris, Jr. Chairman and CEO | 2003 2002 2001 | 455,385 380,000 380,000 | 0 875,000 525,000 | 82,262 88,472 — | — — — | 190,000 — — | 19,618 82,650 82,650 | |||||||

Michael R. Barrington (5) Former CEO & President | 2003 2002 2001 | 641,538 755,058 680,000 | 0 1,775,137 975,000 | 95,464 75,464 — | — — — | — — — | 8,403 47,678 44,770 | |||||||

Daniel E. Berce President | 2003 2002 2001 | 730,000 711,301 655,000 | 0 1,675,103 937,500 | 79,641 68,217 — | — — — | 190,000 — — | 11,635 47,683 47,989 | |||||||

Preston A. Miller Executive Vice President, CFO & Treasurer | 2003 2002 2001 | 385,835 360,000 306,849 | 0 450,000 306,849 | — — — | — 132,764 47,025 | 100,000 31,100 12,800 | 8,995 8,151 8,151 | |||||||

S. Mark Floyd Executive Vice President, COO | 2003 2002 2001 | 340,897 313,273 240,000 | 0 307,280 240,000 | — — — | — 132,764 18,810 | 100,000 50,400 22,000 | 9,141 8,275 1,250 | |||||||

Cheryl L. Miller (6) Senior Vice President, Office of Portfolio Management | 2003 2002 2001 | 340,500 318,000 240,000 | 0 318,000 240,000 | — — — | — 132,764 47,025 | 100,000 31,100 27,800 | 9,396 8,077 7,650 | |||||||

| (1) | Includes Board of Directors fees to Messrs. Morris, Barrington |

| (2) | Includes the use of the Company aircraft valued on the basis of the aggregate incremental cost to the Company of $77,110 for Mr. Morris, $87,712 for Mr. Barrington and $72,520 for Mr. Berce. |

| (3) | The values of the Restricted Stock Awards that are presented in the table are based upon the closing price of $8.55 of the Company's Common Stock on the NYSE on June 30, 2003. On May 1, 2001, Mr. Miller and Ms. Miller were granted 5,500 restricted shares and the value thereof, on the date of grant, was $250,000, and Mr. Floyd was granted 2,200 restricted shares and the value thereof, on the date of grant, was $100,000. On November 1, 2001, Messrs. Miller and Floyd and Ms. Miller were granted 15,528 restricted shares and the value thereof, on the date of grant, was $250,000. These restricted shares vest three years after the date of grant. |

| (4) | The amounts disclosed in this column for fiscal |

| (a) | Company contributions to 401(k) retirement plans |

| (b) | Payment by the Company of premiums for term life insurance on behalf of Mr. Morris, $11,118; Mr. Barrington, |

10

| (5) | On April 23, 2003, Mr. Barrington |

11

Option Grants in Last Fiscal Year

The following table shows all individual grants of stock options to the Named Executive Officers of the Company during the fiscal year ended June 30, 2001.2003.

| Shares of Common Stock Underlying Options Granted (#) | % of Total Options Granted to Employees in Fiscal Year | Exercise Price ($/Sh) | Expiration Date | Grant Date Present Value ($) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Clifton H. Morris, Jr | — | — | — | — | — | ||||||

| Executive Chairman | |||||||||||

| Michael R. Barrington | — | — | — | — | — | ||||||

| Vice Chairman, CEO & | |||||||||||

| President | |||||||||||

| Daniel E. Berce | — | — | — | — | — | ||||||

| Vice Chairman & CFO | |||||||||||

| Edward H. Esstman | — | — | — | — | — | ||||||

| Vice Chairman | |||||||||||

| Michael T. Miller | 150,000 (1) | 6.70 | 28.44 | 11/7/2010 | 2,118,205 | ||||||

| Executive Vice President | |||||||||||

| & COO | |||||||||||

Shares of (#)(1) | % of Total Options Granted to Employees in Fiscal Year | Exercise ($/Sh) | Expiration Date | Grant Date Present Value ($) | |||||||

Clifton H. Morris, Jr. Chairman and CEO | 190,000 | 3.71 | % | 8.79 | 5/28/08 | 1,085,527 | |||||

Michael R. Barrington (3) Former CEO & President | — | — | — | — | — | ||||||

Daniel E. Berce President | 190,000 | 3.71 | % | 8.79 | 5/28/08 | 1,085,527 | |||||

Preston A. Miller Executive Vice President, CFO & Treasurer | 100,000 | 1.95 | % | 8.79 | 5/28/08 | 571,330 | |||||

S. Mark Floyd Executive Vice President, COO | 100,000 | 1.95 | % | 8.79 | 5/28/08 | 571,330 | |||||

Cheryl L. Miller (4) Senior Vice President, Office of Portfolio Management | 100,000 | 1.95 | % | 8.79 | 5/28/08 | 571,330 | |||||

| (1) |

| (2) | As suggested by the |

| (3) | On April 23, 2003, Mr. Barrington stepped down as Chief Executive Officer and President, but continues to serve on the Board of Directors. |

| (4) | On July 14, 2003, the position of President, Consumer Services was eliminated, and Ms. Miller was reassigned to the non-executive position of Senior Vice President, Office of Portfolio Management. |

12

Aggregated Option Exercises in Last Fiscal Year

and FY-End Option Values

Shown below is information with respect to the Named Executive Officers regarding option exercises during the fiscal year ended June 30, 2001,2003, and the value of unexercised options held as of June 30, 2001.2003.

| Name | Shares Acquired on Exercise (#) | Value Realized ($) (1) | Shares of Common Stock Underlying Unexercised Options at FY-End (#) Exercisable/ Unexercisable | Value of Unexercised In-the-Money Options at ($) (2) FY-End Exercisable/ Unexercisable | |||||

|---|---|---|---|---|---|---|---|---|---|

| Clifton H. Morris, Jr | 1,082,666 | 33,390,403 | 1,452,000/568,000 | 60,407,400/22,691,600 | |||||

| Executive Chairman | |||||||||

| Michael R. Barrington | 450,000 | 13,224,768 | 802,000/568,000 | 32,975,900/22,691,600 | |||||

| Vice Chairman, CEO & | |||||||||

| President | |||||||||

| Daniel E. Berce | 582,214 | 18,660,516 | 968,000/568,000 | 40,271,600/22,691,600 | |||||

| Vice Chairman & CFO | |||||||||

| Edward H. Esstman | 300,000 | 7,867,081 | 594,000/396,000 | 23,730,300/15,820,200 | |||||

| Vice Chairman (3) | |||||||||

| Michael T. Miller | 263,760 | 4,421,040 | 0/385,040 | 0/12,716,328 | |||||

| Executive Vice President | |||||||||

| & COO |

Name | Shares Acquired on Exercise (#) | Value Realized ($) | Shares of Common Stock Options at FY-End (#) Exercisable/ | Value of Unexercised FY-End ($)(1) Exercisable/ | ||||

Clifton H. Morris, Jr. Chairman and CEO | 0 | 0 | 1,720,000/190,000 | 165,000/0 | ||||

Michael R. Barrington (2) Former CEO & President | 0 | 0 | 1,235,000/0 | 0/0 | ||||

Daniel E. Berce President | 0 | 0 | 1,820,000/190,000 | 220,000/0 | ||||

Preston A. Miller Executive Vice President, CFO & Treasurer | 0 | 0 | 167,820/129,780 | 91,000/0 | ||||

S. Mark Floyd Executive Vice President, COO | 0 | 0 | 55,220/150,580 | 0/0 | ||||

Cheryl L. Miller (3) Senior Vice President, Office of Portfolio Management | 0 | 0 | 71,520/133,080 | 7,800/0 | ||||

| (1) |

| Values stated are pre-tax, net of cost and are based upon the closing price of |

| (2) | On April 23, 2003, Mr. Barrington stepped down as Chief Executive Officer and President, but continues to serve on the Board of Directors. |

| (3) |

13

Report of the Stock Option/Compensation Committee on Executive Compensation

During fiscal 2001,2003, the Stock Option/Compensation Committee of the Board of Directors (the "Committee"“Committee”) was comprised of Messrs. Dike, Greer, Higgins and Jones. The Committee is responsible for all elements of the total compensation program for executive officers and senior management personnel of the Company, including stock option grants and the administration of other incentive programs.

General

The objectives of the Company'sCompany’s compensation strategy isremain as follows: (i) to attract and retain the best possible executive talent, (ii) to motivate its executives to achieve the Company'sCompany’s goals, (iii) to link executive and shareholder interest through compensation plans that provide opportunities for management to become substantial shareholders in the Company and (iv) to provide a compensation package that appropriately recognizes both individual and corporate contributions.

Reorganization of Executive Team in Fiscal 2003

On April 23, 2003, the Board of Directors expanded the duties of Mr. Morris by returning him to the position of Chief Executive Officer. Mr. Morris replaced Mr. Barrington, who has stepped down as President and Chief Executive Officer. To fill the position of President, the Board of Directors promoted Mr. Berce, formerly the Company’s Chief Financial Officer. The Board of Directors also promoted Mr. Preston A. Miller to Chief Financial Officer and Mr. Floyd from President of Dealer Services to Chief Operating Officer replacing Mr. Michael T. Miller, who stepped down.

Components of Compensation of Named Executive Officers.Officers in Fiscal 2003

Compensation paid to the Company'sCompany’s Named Executive Officers in fiscal 20012003 consisted of the following: base salary and annual bonus. With the exception of Mr. Miller, no stock options or other long-term incentive awards were made to the Company's Named Executive Officers in fiscal 2001.awards.

Base Salary

Employment agreements have been entered into between the Company and each of the Named Executive Officers. All of these employment agreements, which are described in greater detail elsewhere in this Proxy Statement, provide for a certain minimum annual base salary with salary increases, bonuses and other incentive awards to be made at the discretion of this Committee.

No base salary increase wasincreases were made during fiscal 20012003 for Mr. Morris.Berce. Effective July 1, 2000,2002, the Committee authorized base salary increases of $50,000 for Mr. Barrington, $25,000 for Messrs. Berce and Esstman and $35,000 for Mr. Miller. In connection with his promotion to co-Chief Operating Officer, Mr. Miller received a $40,000 base salary increase effective October 29, 2000.of $25,500 for Mr. Preston A. Miller, to $385,500 annually, $26,227 for Mr. Floyd, to $339,500 and $22,500 for Ms. Miller, to $340,500. Effective April 23, 2003, the Committee authorized a base salary increase of $350,000 for Mr. Morris, to $750,000 annually. The increasesincrease for Messrs. Barrington, Berce, Esstman and Miller wereMr. Morris was considered appropriate in light of the continuing growth and financial successhis re-assumption of the Company and, in the case of Mr. Miller, his promotion to co-Chief Operating Officerchief executive position of the Company.

In light

Annual Bonus

For fiscal 2003, the Company made a decision not to award annual bonuses for any officers as part of his resignation as co-Chief Operating Officera broader plan to reduce costs, improve liquidity and increase profitability. Accordingly, no bonuses were paid during fiscal 2003 to the Company’s Named Executive Officers. Further, the Company’s financial results for fiscal 2003 did not achieve any of the Company, Mr. Esstman's base salary was reduced from $425,000 to $225,000 as of August 7, 2001.

Annual Incentive

The purpose of annual incentive bonus awards is to encourage executive officers and key management personnel to exercise their best efforts and management skills toward achieving the Company's predetermined objectives. In fiscal 2001, the CEO and the other Named Executive Officers received annual incentive awards equal to between 100% and 150% of their base salary. As described in the Company's 2000 Proxy Statement, these bonus awards were made in return for the Company's successfully meeting earnings per share targets previously established by the Committee prior tofor bonus payments. The Committee is presently considering, but has not finalized or adopted, a proposed incentive plan for fiscal 2001. Under this plan, minimum earnings levels were required to be obtained before any bonuses were awarded; the plan also defined maximum award levels. Based on the Company's earnings per share in fiscal 2001, the maximum bonus target was achieved2004 for the CEO and the other Named Executive Officers.

For fiscal 2002, the Committee has approved an incentive plan similar to the plan in effect for fiscal 2001,Company’s senior executive officers, including the establishmentChief Executive Officer, that will provide bonus opportunities upon the Company’s achievement of certain earnings, per share targetsreturn on assets and award levels associated withother operating objectives established by the Company's success in meeting those targets.Committee.

14

Long-Term Incentive Award

In light of the

The Committee approved stock options grantedoption grants to the Named Executive Officers under the 1998 Limited Stock Option Plan (the "1998 Plan"), approved by shareholders at the 1998 Annual Meeting, no stock option grants were made in fiscal 2001 to the Named Executive Officers, other than Mr. Miller. In connection with his promotion to co-Chief Operating Officer, Mr. Miller was granted a stock option for 150,000 shares on November 7, 2000May 29, 2003 at an exercise price of $28.44 per share.

As noted in$8.79, the 1998 Proxy Statement, there will be no further stock-based,closing market price on that date. These were the first long-term incentive awards made to Messrs. Morris Barrington,and Berce since January 1998, and Esstman until the first awards made to Messrs. Miller and Floyd and Ms. Miller since November 2001. The “Option Grants in Last Fiscal Year” table on page 12 summarizes stock options covered byoption grants in fiscal 2003 to the 1998 Plan are fully vested and exercisable. Furthermore, the 2000 Limited Omnibus and Incentive Plan for AmeriCredit Corp. specifically provides that Messrs. Morris, Barrington, Berce and Esstman are not eligible to participate in such Plan.Named Executive Officers.

Other Compensation Plans

The Company maintains certain broad-based employee benefit plans in which executive officers are permitted to participate on the same terms as non-executive personnel who meet applicable eligibility criteria, subject to any legal limitations on the amounts that may be contributed or the benefits that may be payable under the plans.

In addition, the Committee has previously approved a split-dollar life insurance program for Messrs. Morris, Barrington, Berce and Esstman. Under this program, the Company advances annual premiums forBarrington. Messrs. Morris, Berce and Barrington terminated their respective split-dollar life insurance policies on these officers, subject to the right of the Company to recover certain amountsarrangements in the event of the officer's death or termination of employment. As adopted by the Committee, the annual premiums will be approximately $75,000 in the case of Mr. Morris and $37,500 in the case of Messrs. Barrington, Berce and Esstman.2003.

Stock Ownership Guidelines for Executive Officers

In August 2000, the Board of Directors adopted stock ownership guidelines that are designed to encourage the accumulation of the Company'sCompany’s stock by its executive officers. TheseIn August 2003, the Committee amended and restated the stock ownership guidelines principally to (i) reflect revisions in executive management participating therein, (ii) extend the transition date by two and a half years as a result of the decline in the Company’s stock price throughout fiscal 2002 and 2003 and (iii) establish a minimum number of shares that must be owned by participants in order to comply with ownership levels, notwithstanding price fluctuations that may occur from time to time in the Company’s stock. The revised guidelines, stated as a multiple of executives'executives officers’ base salaries and the minimum number of shares that must be owned by executive officers, are as follows: Chairman and Vice Chairmen, four times; Segment Presidents and Treasurer, three times; other Executive Team members, two times.

Position | Base Salary Multiple | Number of Shares To Be Directly Owned | ||

Chairman, Chief Executive Officer and President | 4X | 150,000 | ||

Chief Financial Officer, Chief Operating Officer | 3X | 60,000 | ||

and Chief Legal Officer | ||||

Other Executive Team Members | 2X | 25,000 |

The recommended time period for reaching the above guidelines is the later of (i) August 1, 2003,December 31, 2005, (ii) five years from date of hire or (iii) three years from date of promotion to an executive officer position. These guidelines are subject to periodic review to ensure that the levels are appropriate. Shares of the Company'sCompany’s stock directly owned by an executive officer and shares owned by an executive officer through the Company's 401kCompany’s 401(k) and employee stock purchase programs constitute qualifying ownership;ownership, and shares of restricted stock owned by an executive officer, whether or not vested, would also qualify. Stock options are not counted towards compliance with the guidelines. The Committee will review the progress of each executive officer toward compliance with the guidelines and, in the event an officer is not making satisfactory progress, the Committee may reduce prospective stock option or restricted share grants to such executive officer.

As of September 20, 2001, the value

Presently, all of the Company stock owned by each executive officer subjectNamed Executive Officers other than Mr. Floyd own more than the minimum number of shares necessary to comply with the stock ownership guidelines exceeded the required amount, with the exception of five executive officers, three of whom were newly hired or promoted into executive officer positions within the past two years.guidelines.

Fiscal 20012003 Compensation of CEO

During

Mr. Barrington’s salary for fiscal 2001,2003, through April 23, 2003 when he stepped down as the Company’s Chief Executive Officer and President, was $641,538. Upon his separation of employment, the Company entered

15

into a separation agreement with Mr. Barrington received $650,000to provide a separation payment, calculated pursuant to an employment agreement previously entered into between Mr. Barrington and the Company, in the amount of $4,786,892 ($2,564,880 was applied first to the repayment in full of indebtedness owed to the Company by Mr. Barrington under a note) and a consulting fee in the amount of $125,000 per year in exchange for his agreement to provide certain services for up to 360 hours per year over a 24 month period beginning May 1, 2003. Under the agreement, Mr. Barrington also agreed to a two-year non-compete and non-solicitation agreement and provided a release of all claims against the Company and related entities and parties. In fiscal 2003, no annual bonus or stock options were awarded to Mr. Barrington.

Mr. Morris reassumed the position of Chief Executive Officer on April 23, 2003. The Committee authorized an increase in the annual rate for Mr. Morris’ base salary, a salary the Committee believes is in-line with the base salaries paideffective April 23, 2003, from $350,000 per year to the top executive officer at similarly-sized financial services companies and at the companies previously reviewed by the Committee located within the Dallas-Fort Worth area.$750,000 per year. The decision to increase Mr. Barrington'sMorris’ base salary was established in July 2000 in connectionconsistent with his promotion to CEO. The salary amount shownthe increased responsibilities and duties he reassumed upon becoming the Company’s Chief Executive Officer. In addition, the Company granted Mr. Morris a stock option for Mr. Barrington in the "Executive Compensation - Summary Compensation Table"190,000 shares on page 8May 28, 2003 at an exercise price of this Proxy Statement includes director fees in addition to his base salary.

As discussed above, Mr. Barrington also received a cash$8.79 per share. In fiscal 2003, no annual bonus under the 2001 incentive plan equal to 150% of his base salary, an award that represented the maximum bonus opportunity for Mr. Barrington. No stock options or other stock-based, long-term incentive awards were madewas awarded to Mr. Barrington during fiscal 2001.Morris.

DOUGLAS K. HIGGINS (CHAIRMAN)

A. R. DIKE

JAMES H. GREER

KENNETH H. JONES, JR.

Notwithstanding anything to the contrary set forth in any of the Company'sCompany’s previous filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate future filings, including this Proxy Statement, in whole or in part, the preceding report and the Performance Graph on page 1418 shall not be incorporated by reference into any such filings.

Certain Agreements

Employment Contracts, Termination of Employment and Change-in Control Arrangements

The Company has entered into employment agreements with all of its Named Executive Officers.Officers, other than Mr. Barrington whose employment agreement was terminated pursuant to his separation agreement discussed below. These agreements, as amended, contain terms that renew annually for successive five year periods (ten years in the case of Mr. Morris), and the compensation thereunder is determined annually by the Company's Board of Directors,Stock Option/Compensation Committee, subject to the following minimum annual compensation: Mr. Morris, $350,000; Messrs. Barrington andMr. Berce, $345,000; Mr. Esstman, $225,000;Miller, $145,000; Mr. Floyd $115,000; and Mr.Ms. Miller $255,000.$145,000. Included in eachthe agreement for Messrs. Morris and Berce is a covenant of the employee not to compete with the Company during the term of his employment and for a period of three years from the date on which he ceased to be employed as a result of a termination for due cause or voluntary termination unless such voluntary termination occurs within twelve months after a “change in control” (as that term is defined in the employment agreements). Included in the agreement for Messrs. Miller and Floyd and Ms. Miller is a covenant of the employee not to compete with the Company during the term of his or her employment and for a period of one year thereafter. The employment agreements alsofor Messrs. Morris and Berce provide that if the employee is terminated by the Company other than for cause, or in the event the employee resigns or is terminated other than for cause within twelve months after a "change“change in control"control” of the Company, (as that term is defined in the employment agreements), the Company will pay to the employee the remainder of his current year'syear’s salary (undiscounted) plus the discounted present value (employing an interest rate of 8%) of two additional years'years’ salary. The employment agreements for Messrs. Miller and Floyd and Ms. Miller provide that, in the event of a termination or resignation under the circumstances described in the immediately preceding sentence, the Company will pay to Messrs. Miller and Floyd and Ms. Miller, as the case may be, an amount equal to one year’s salary. For all Named Executive Officers other than Messrs.Mr. Morris, and Esstman, "salary"“salary” includes the annual rate of compensation immediately prior to the "change“change in control"control” plus the average annual cash bonus for the immediately preceding three-year period; for Messrs.period. For Mr. Morris, and Esstman, "salary"“salary” includes the highest annual rate of compensation plus the highest annual cash bonus or other incentive payment provided in any of the seven fiscal yearyears preceding the year in which a "change“change of control"control” occurs.

16

In addition to the employment agreements described above, the terms of all stock options granted to the Named Executive Officers provide that such options will become immediately vested and exercisable upon the occurrence of a change in control as defined in the stock option agreements evidencing such grants.

The provisions and terms contained in these employment and option agreements could have the effect of increasing the cost of a change in control of the Company and thereby delay or hinder such a change in control.

Barrington Separation Agreement

Mr. Barrington stepped down as Chief Executive Officer and President on April 23, 2003. The Company entered into a separation agreement with Mr. Barrington pursuant to which Mr. Barrington received a separation payment, calculated pursuant to his employment agreement, in the amount of $4,786,892 ($2,564,880 was applied first to the repayment in full of indebtedness owed to the Company by Mr. Barrington under a note), and a consulting fee in the amount of $125,000 per year in exchange for his agreement to provide certain services for up to 360 hours per year over a 24 month period beginning May 1, 2003. Under the separation agreement, Mr. Barrington also agreed to a two-year non-compete and non-solicitation agreement and provided a release of all claims against the Company and related entities and parties. The Company also agreed to reimburse Mr. Barrington for all reasonable out-of-pocket expenses incurred by him in the performance of his consulting services. Mr. Barrington continues to serve on the Board of Directors.

17

Performance Graph

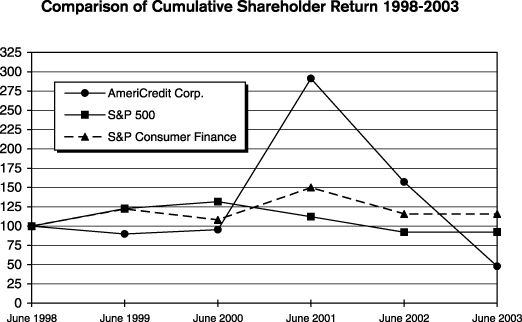

The following graph presentsperformance graphs present cumulative shareholder returnreturns on the Company'sCompany’s Common Stock for the five years ended June 30, 2001. The2003. In the five-year performance graph, the Company is compared to (i) the S&P500&P 500 and (ii) the S&P Consumer Finance Index. S&P recently split the S&P Financial Index into the S&P Consumer Finance Index and the S&PFinancial&P Diversified Financial Services Index. Each Index assumes $100 invested at the beginning of the measurement period and is calculated assuming quarterly reinvestment of dividends and quarterly weighting by market capitalization.

The data source for the graph is Media General Financial Services, Inc., an authorized licensee of S&P.

| June 1998 | June 1999 | June 2000 | June 2001 | June 2002 | June 2003 | |||||||||||||

AmeriCredit Corp. | $ | 100.00 | $ | 89.67 | $ | 95.27 | $ | 291.14 | $ | 157.20 | $ | 47.92 | ||||||

S&P 500 | $ | 100.00 | $ | 122.76 | $ | 131.66 | $ | 112.13 | $ | 91.96 | $ | 92.19 | ||||||

S&P Consumer Finance | $ | 100.00 | $ | 122.30 | $ | 107.95 | $ | 149.99 | $ | 115.56 | $ | 115.56 | ||||||

Comparison of Cumulative Shareholder Return1996-2001

June 1996 June 1997 June 1998 June 1999 June 2000 June 2001 AmeriCredit Corp. $100.00 $134.40 $228.40 $204.80 $217.60 $664.96 S&P 500 $100.00 $134.70 $175.33 $215.22 $230.83 $196.59 S&P Financials $100.00 $152.01 $211.22 $228.70 $209.68 $258.97

The Company'sCompany’s executive officers and directors are required to file under the Securities Exchange Act of 1934, as amended, reports of ownership and changes of ownership with the SEC. Based solely upon information provided to the Company by individual directors and executive officers, the Company believes that during the fiscal year ended June 30, 2001,2003, all filing requirements applicable to its executive officers and directors were met.

Related Party Transactions

The Company engagespreviously engaged independent contractors to solicit business from motor vehicle dealers in certain geographic locations. During fiscal 2001, oneOne such independent contractor was CHM Company, L.L.C. ("(“CHM Company"Company”), a Delaware limited liability company, that is controlled by Clifton H. Morris, III, an adult son of Mr. Clifton H. Morris, Jr., Chairman and Chief Executive ChairmanOfficer of the Company. A per contract commission iswas paid to CHM Company for each motor vehicle contract originated by the Company that is attributable to the marketing efforts

18

of CHM Company. Commission payments of $1,813,941 were made by the Company to CHM Company during fiscal 2001. Out of payments received from the Company, CHM Company pays all of its expenses, including salaries and benefits for its employees and marketing representatives, office expenses, travel expenses and promotional costs. The Company'sCompany’s contractual arrangement with CHM Company has beenwas cancelled effective December 31, 2000. Although the contract has been cancelled, CHM Company is entitled to continue receiving monthly payments per the original contract terms with respect to motor vehicle contracts originated by CHM Company prior to contract termination that meet certain portfolio performance criteria. The Company made payments of $156,594 to CHM Company during fiscal 2003.

The Company selects independent contractors on a competitive bid basis from a group of qualified vehicle recovery and repossession agencies with whom it maintains ongoing relationships. During fiscal 2003, the Company engaged Texas Expeditors of Dallas/Fort Worth, LP (“Expeditors of DFW”), a Texas limited partnership, Texas Expeditors of San Antonio, LP (“Expeditors of San Antonio”), a Texas limited partnership, and Texas Expeditors of Houston, LP (“Expeditors of Houston”), a Texas limited partnership, as three of its vehicle recovery agencies. These recovery agencies are controlled by Clifton H. Morris, III, an adult son of Mr. Clifton H. Morris, Jr., Chairman and Chief Executive Officer of the Company. A per vehicle payment is made pursuant to a fee schedule submitted by Expeditors of DFW, Expeditors of San Antonio and Expeditors of Houston for each recovery, repossession or other service performed. During fiscal 2003, payments of $453,876, $271,029 and $303,047 were made by the Company to Expeditors of DFW, Expeditors of San Antonio and Expeditors of Houston, respectively. The aggregate amount of payments the Company paid in fiscal 2003 to the three vehicle recovery companies controlled by Clifton H. Morris, III represented approximately 2% of the total recovery and repossession fees paid by the Company to all vehicle recovery agencies in fiscal 2003.

On September 21, 2000,2001, Messrs. BarringtonBerce and Berce, executive officers of the Company,Barrington each executed Amended and Restated Revolving Credit Notes in the amount of $1,000,000$2,500,000 in favor of the Company. These Notes,notes, which modifymodified and extendextended notes in the principal amount of $1,000,000 executed by Messrs. BarringtonBerce and BerceBarrington in September 1999, bear2000, bore interest at a rate equal to LIBOR plus 1%, and provideprovided that Messrs. Berce and Barrington and Berce cancould borrow, repay and reborrow from time to time thereunder. The Notes mature in full on the earlier to occur of September 20, 2001 or separation of employment for any reason. During fiscal 2001,2003, the largest amount of indebtedness outstanding under Mr. Barrington'sBerce’s note was $970,354;$1,000,349; Mr. BarringtonBerce paid off his note in full on August 31, 2001.7, 2002, and such note was cancelled and is not available for further borrowing. During fiscal 2001,2003, the largest amount of indebtedness outstanding under Mr. Berce's loanBarrington’s note was $999,996;$2,564,880; on April 23, 2003, the net proceeds payable to Mr. Berce paid offBarrington pursuant to his loan on May 14, 2001.separation agreement were applied first to the repayment in full of amounts owed to the Company by Mr. Barrington under the note, and such note was cancelled and is not available for further borrowing.

In August 2000, the Board of Directors adopted stock ownership guidelines that are designed to encourage the accumulation of the Company's stock by its executive officers. These guidelines, stated as a multiple of executives' base salaries, are as follows: Chairman and Vice Chairmen, four times; Segment Presidents and Treasurer, three times; other Executive Team members, two times. The recommended time period for reaching the above guidelines is the later of (i) August 1, 2003, (ii) five years from date of hire or (iii) three years from date of promotion to an executive officer position. Shares of the Company's stock directly owned by an executive officer and shares owned by an officer through the Company's 401k and employee stock purchase programs constitute qualifying ownership; stock options are not counted towards compliance with the guidelines. The Board of Directors also adopted an Officer Stock Loan Program (the “Program”) to facilitate compliance with the stock ownership guidelines.guidelines as discussed in the “Report of the Stock Option/Compensation Committee on Executive Compensation” on page 14. Executive officers may utilizeutilized loan proceeds to acquire and hold common stock of the Company by means of option exercise or otherwise. The loans, executed by executive officers, bear interest at a rate equal to LIBOR plus 1%. The stock to be held as a result of a loan under the programProgram must be pledged to the Company. The aggregate principal balance of all outstanding loans under the programProgram may not exceed $20,000,000 at any time. Messrs. BarringtonOn July 29, 2002, the Stock Option/Compensation Committee terminated the Program and Berce obtained loansapproved amendments to the outstanding revolving promissory note and pledge agreements under this programthe Program between the Company and three (3) executive officers which provided that each officer repay amounts in full, including principal and interest, on the earlier to occur of: (i) December 31, 2003; or (ii) sixty days after the last day of the officer’s employment with the Company. The executive officers described below had indebtedness under the Program that exceeded $60,000 during fiscal 2001. The2003.

Mr. Michael T. Miller obtained a loan under the Program during fiscal 2002. During fiscal 2003, the largest amount of indebtedness outstanding under Mr. Barrington'sMiller’s loan was $414,813;$893,567. On April 23, 2003, Mr. Barrington paid offMiller stepped down as Chief Operating Officer. The Company entered into a separation agreement with Mr. Miller pursuant to which Mr. Miller received a separation payment, calculated pursuant to his employment agreement, in the amount of $2,131,923 of which $893,567 was applied first to the repayment in full of Mr. Miller’s loan.

19

Mr. Joseph E. McClure obtained a loan on August 31, 2001. Theunder the Program during fiscal 2002. During fiscal 2003, the largest amount of indebtedness outstanding under Mr. Berce'sMcClure’s loan was $204,263; Mr. Berce paid off his loan on February 2, 2001.

The Company's Charter currently authorizes$1,353,343, and the issuance of 120,000,000 shares of Common Stock, par value of $.01 per share. Asamount outstanding as of June 30, 2001, 89,853,792 shares were issued and outstanding (including 6,439,737 Treasury Shares), and another 14,083,484 shares were subject2003 was $1,353,343. In July 2003, Mr. McClure was reassigned to unexercised stock options granted pursuanta non-executive position.

All loans made to executive officers, including loans made under the Program, provide for full personal recourse to the Company's stock option plans, reserved for issuance pursuant to future grants under the Company's stock option plans, or reserved for issuance under the Company's employee stock purchase plan. This leavesexecutive officers, and the Company has no agreements, written or oral, with only 16,062,724 shares currently available for other purposes.its executive officers to cancel or forgive such indebtedness in the future.

Additionally,

In fiscal 2003, the Company alsopurchased retail installment contracts originated by automobile dealerships owned directly or indirectly by Mr. McCombs (or in which he has a shelf registration statement relating tofinancial interest) in an amount that did not exceed 1% of the registration of a variety of security offerings with an aggregate offering price of up to $500,000,000 available for issuance thereunder. The Company may choose to offer, from time to time, debt securities, shares of preferred stock, shares of common stock, depositary shares representing preferred stock or warrants for debt and equity securities on such terms to be set forth in the prospectus contained in the registration statement or in one or more supplements to such prospectuses. Any issuance of equity securitiestotal retail installment contracts purchased by the Company under this registration statement would further deplete the remaining number of authorized shares.

On August 7, 2001, the Board of Directors unanimously adopted a resolution setting forth a proposed amendment to the Company's Articles of Incorporation to increase the number of shares of Common Stock which the Company is authorized to issue from 120,000,000 to 230,000,000. No changes are proposed to increase the amount of authorized preferred shares of the Company. The resolution adopted by the Board of Directors presented for approval by the shareholders at the Annual Meeting is set forth below:in fiscal 2003.

RESOLVED, that Section 4.1 of Article IV of the Articles of Incorporation of the Company be amended so that, as amended, Section 4.1 shall read in its entirety as follows:

The Board of Directors believes that the Company's Articles of Incorporation should be amended to allow the Company flexibility to issue additional shares of Common Stock for corporate purposes as considered appropriate by the Board of Directors. Such future activities may include, without limitation, possible future financing and acquisition transactions, increasing working capital, raising additional capital for operations of the Company, secondary offerings, stock splits or stock dividends and grants under the Company's equity-based compensation plans. As of the date on which this Proxy Statement is being mailed, there are no arrangements, agreements or understandings for the issuance or use of the additional shares of authorized Common Stock other than issuances permitted or required under the Company's existing stock-based employee benefits plans.

The Board of Directors believes that the proposed amendment will provide several long-term advantages to the Company and its shareholders. The passage of the proposed amendment would enable the Company to pursue financings or enter into transactions which the Board of Directors believes provide the potential for growth and profit. If additional authorized shares are available, transactions dependent upon the issuance of additional shares are less likely to be undermined by delays and expenses occasioned by the need to obtain shareholder authorization to provide the shares necessary to consummate such transactions. Without an increase in authorized shares of Common Stock, the Company may have to rely on debt, seek alternative financing means or forgo an investment opportunity altogether.

In addition to the corporate purposes discussed above, the proposed amendment could have an anti-takeover effect, although this is not the intent of the Board of Directors. For example, if the Company were the subject of a hostile takeover attempt, it could try to impede the takeover by issuing shares of Common Stock, thereby diluting the voting power of the other outstanding shares and increasing the cost of the takeover. The availability of this defensive strategy to the Company could discourage unsolicited takeover attempts. By potentially discouraging initiation of any such unsolicited takeover attempts, the proposed amendment may limit the opportunity for shareholders to realize a higher price for their shares than is generally available in takeover attempts. The Board of Directors is not aware of any attempt, or contemplated attempt, to acquire control of the Company, and the Board of Directors has not presented this proposal with the intent that it be utilized as a type of anti-takeover device.

Shareholders do not have preemptive rights or similar rights to subscribe for or purchase any additional shares of Common Stock that may be issued in the future. If the Board of Directors elects to issue additional shares of Common Stock, such issuance may, depending on the circumstances, have a dilutive effect on the earnings per share and other interests of the existing shareholders.

Under the Texas Business Corporation Act, adoption of the proposed amendment requires the affirmative vote of the holders of at least two-thirds of the outstanding shares entitled to vote at the Annual Meeting. The effect of an abstention is the same as that of a vote against the approval of the proposed amendment.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE "FOR" THE ADOPTION OF THE PROPOSAL TO AMEND AMERICREDIT CORP.'S ARTICLES OF INCORPORATON TO INCREASE THE AUTHORIZED NUMBER SHARES OF COMMON STOCK FROM 120,000,000 TO 230,000,000.

EMPLOYEE STOCK PURCHASE PLAN

(Item 3)2)